IIii:

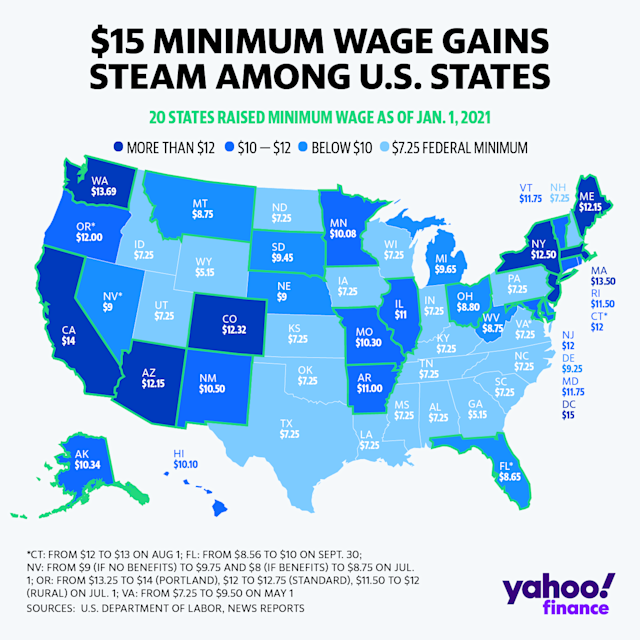

一些市縣的最低工資高於州的最低工資標準。加州大學伯克利分校一份加州市縣最低工資清單。

https://laborcenter.berkeley.edu/inventory-of-us-city-and-county-minimum-wage-ordinances/#s-2

而劳工法在今年将会面临数十项不同方面的改变,雇主及人事主管需特别留意详情请看

https://www.dir.ca.gov/letf/LETF_Worker_Booklet_Chinese.pdf

加州新帶薪病假法案7月1日起生效

領取社安退休金的最佳策略

|

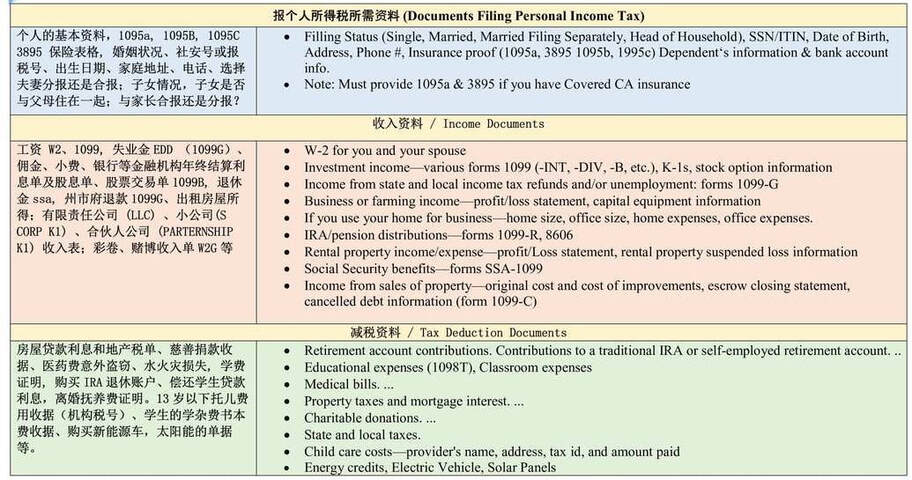

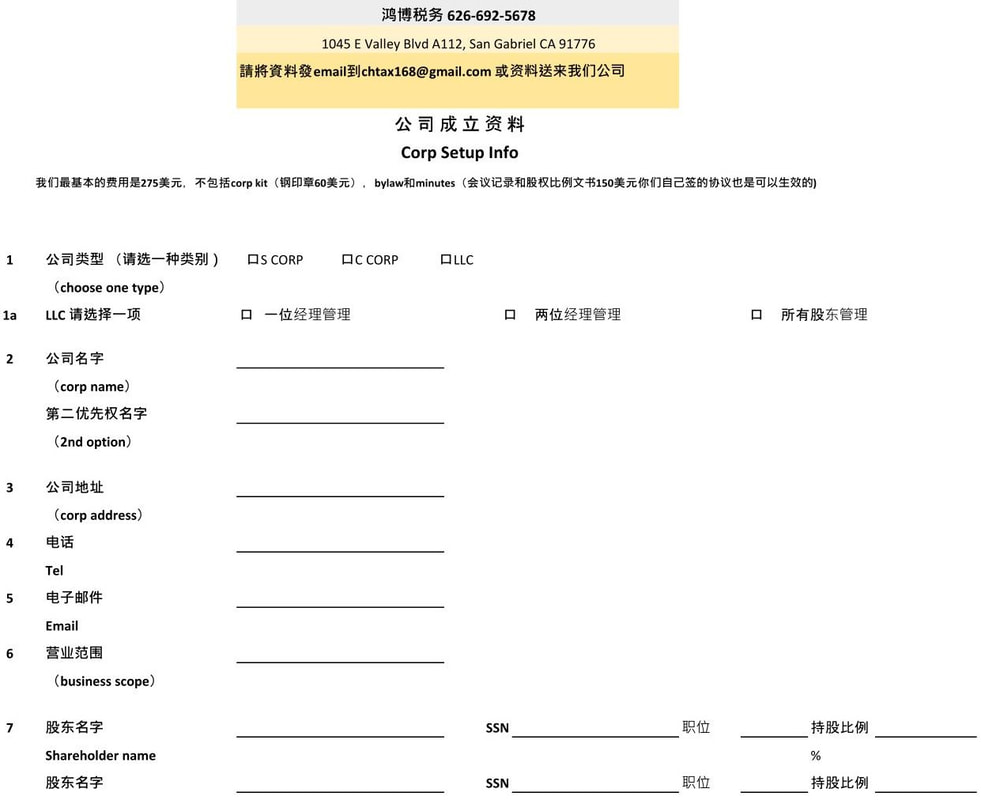

CH Accounting & Tax Services Inc

鴻博稅務 1045 E. Valley Blvd. A112 San Gabriel, CA 91776, USA Tel: (626) 692-5678 Fax: 888-299-6858 email: chtax168@gmail.com |

Disclaimer:

We are not licensed by the State Certified Public Accountant. Our bookkeeping services being offered do not require a state license. We are enrolled agents licensed by Internal Revenue Service and can represent clients before Internal Revenue Service.

We are not licensed by the State Certified Public Accountant. Our bookkeeping services being offered do not require a state license. We are enrolled agents licensed by Internal Revenue Service and can represent clients before Internal Revenue Service.

Copyright © 2015